Question: The Number Of Days To Recapture The Project Initial Outlay If You Were Given That The Payback Period Equals 1.2 And The Days Of The Year = 360 Select One: A. 380 Days B. 432 Days C. None Of The Above D. 482 Days If The Total Cash Flows = 22,000 And The Cash Flow At The End Of The Period = 200,000 Then The Cash Flow At The Beginning Of The Period Equals …

Transcribed Image Text from this Question

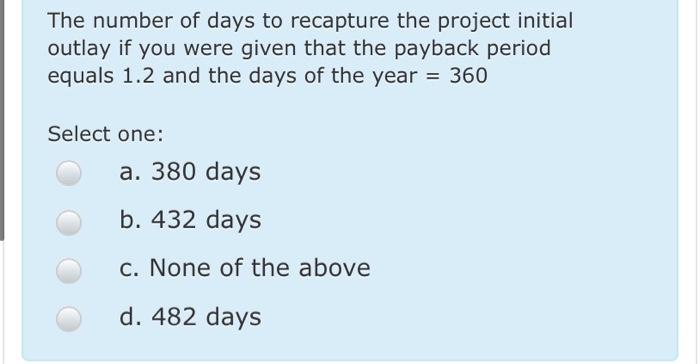

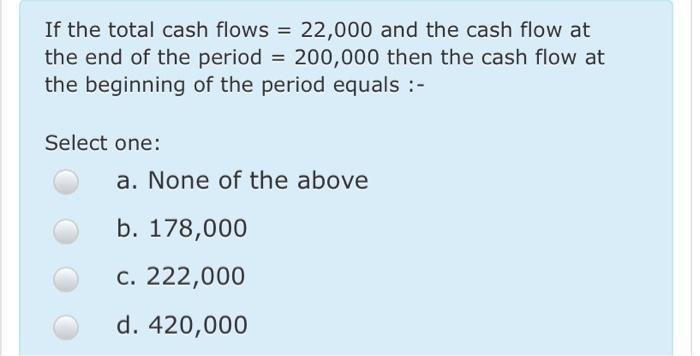

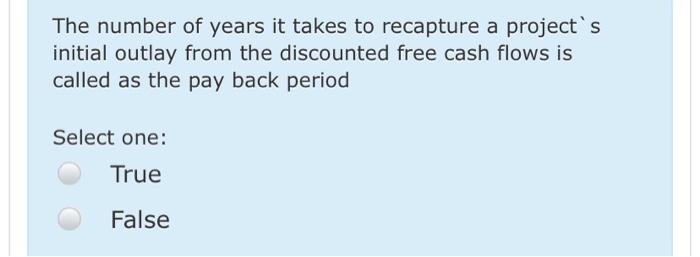

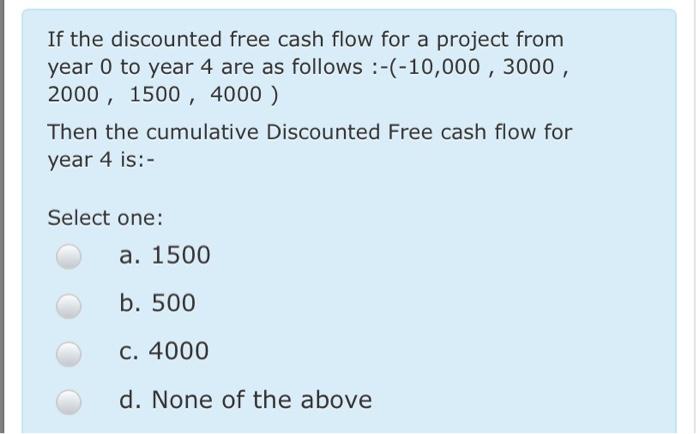

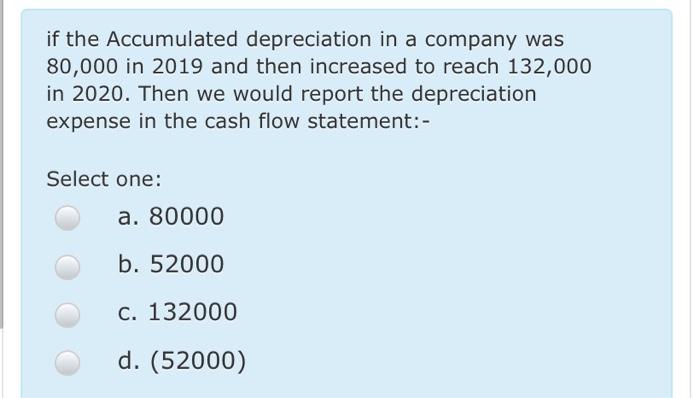

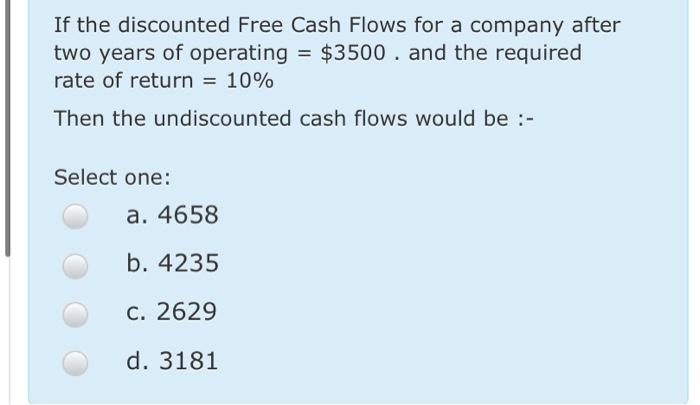

The number of days to recapture the project initial outlay if you were given that the payback period equals 1.2 and the days of the year = 360 Select one: a. 380 days b. 432 days c. None of the above d. 482 days If the total cash flows = 22,000 and the cash flow at the end of the period = 200,000 then the cash flow at the beginning of the period equals :- Select one: a. None of the above b. 178,000 c. 222,000 d. 420,000 The number of years it takes to recapture a project’s initial outlay from the discounted free cash flows is called as the pay back period Select one: True False If the discounted free cash flow for a project from year 0 to year 4 are as follows :-(-10,000, 3000, 2000, 1500, 4000 ) Then the cumulative Discounted Free cash flow for year 4 is: – Select one: a. 1500 b. 500 c. 4000 d. None of the above if the Accumulated depreciation in a company was 80,000 in 2019 and then increased to reach 132,000 in 2020. Then we would report the depreciation expense in the cash flow statement:- Select one: a. 80000 b. 52000 c. 132000 d. (52000) If the discounted Free Cash Flows for a company after two years of operating = $3500 . and the required rate of return = 10% Then the undiscounted cash flows would be :- Select one: a. 4658 b. 4235 c. 2629 d. 3181