Question: Question 4 On 1st January 2021 A British Exporter Sells GBP420 Million Of Cars’ Accessories To An Italian Firm. The Importer Is Sent An Invoice For EUR453.6 Million Payable In 4 Months’ Time. The Spot Rate Of Exchange Between The British Pound And Euros Is EUR 1.08 = GBP 1.00. Required: A) If The Spot Rate Of Exchange In 4 Months Is EUR 1.10 = GBP 1.00. …

Transcribed Image Text from this Question

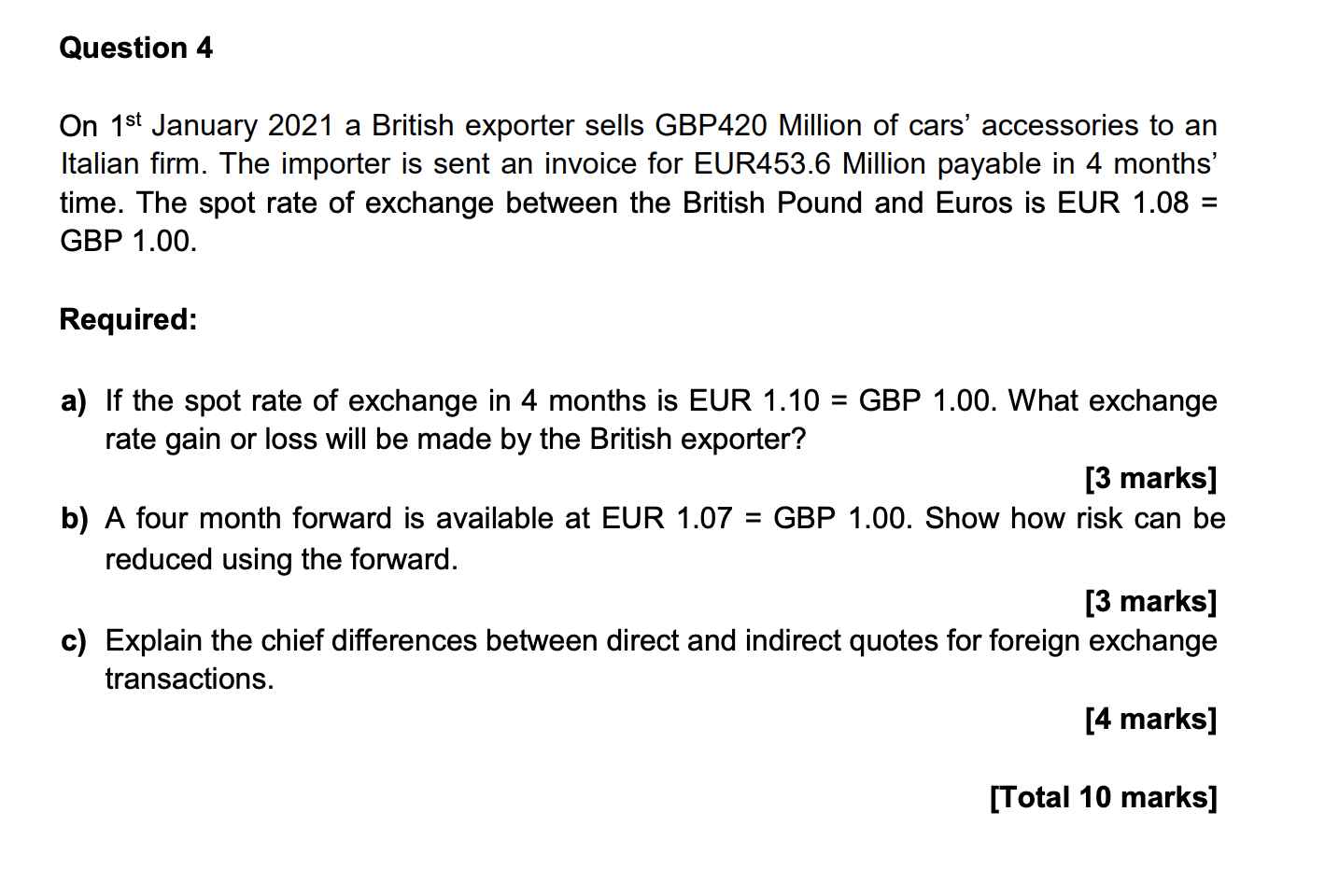

Question 4 On 1st January 2021 a British exporter sells GBP420 Million of cars’ accessories to an Italian firm. The importer is sent an invoice for EUR453.6 Million payable in 4 months’ time. The spot rate of exchange between the British Pound and Euros is EUR 1.08 = GBP 1.00. Required: a) If the spot rate of exchange in 4 months is EUR 1.10 = GBP 1.00. What exchange rate gain or loss will be made by the British exporter? [3 marks] b) A four month forward is available at EUR 1.07 = GBP 1.00. Show how risk can be reduced using the forward. [3 marks] c) Explain the chief differences between direct and indirect quotes for foreign exchange transactions. [4 marks] [Total 10 marks]