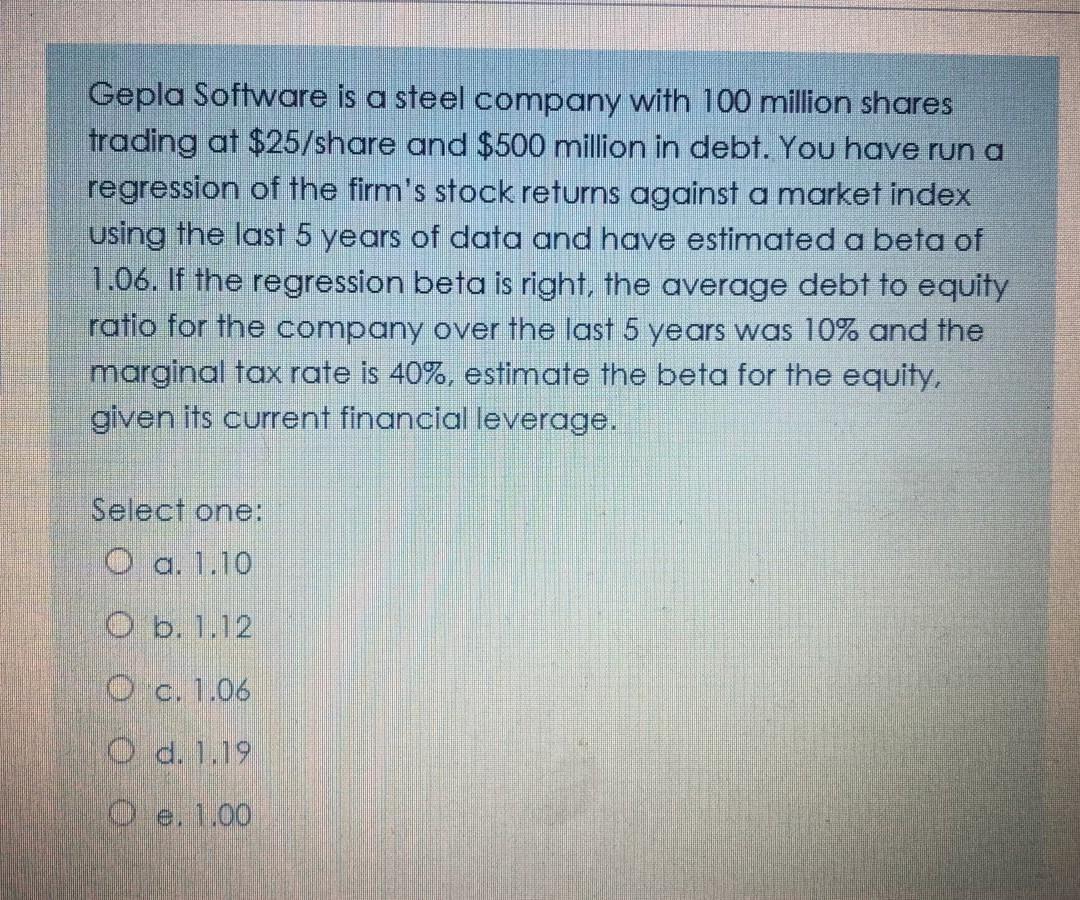

Question: Gepla Software Is A Steel Company With 100 Million Shares Trading At $25/share And $500 Million In Debt. You Have Run A Regression Of The Firm’s Stock Returns Against A Market Index Using The Last 5 Years Of Data And Have Estimated A Beta Of 1.06. If The Regression Beta Is Right, The Average Debt To Equity Ratio For The Company Over The Last 5 Years …

Transcribed Image Text from this Question

Gepla Software is a steel company with 100 million shares trading at $25/share and $500 million in debt. You have run a regression of the firm’s stock returns against a market index using the last 5 years of data and have estimated a beta of 1.06. If the regression beta is right, the average debt to equity ratio for the company over the last 5 years was 10% and the marginal tax rate is 40%, estimate the beta for the equity, given its current financial leverage. Select one: O a. 1.10 O b. 1.12 O c. 1.06 O d. 1.19 O e. 1.00