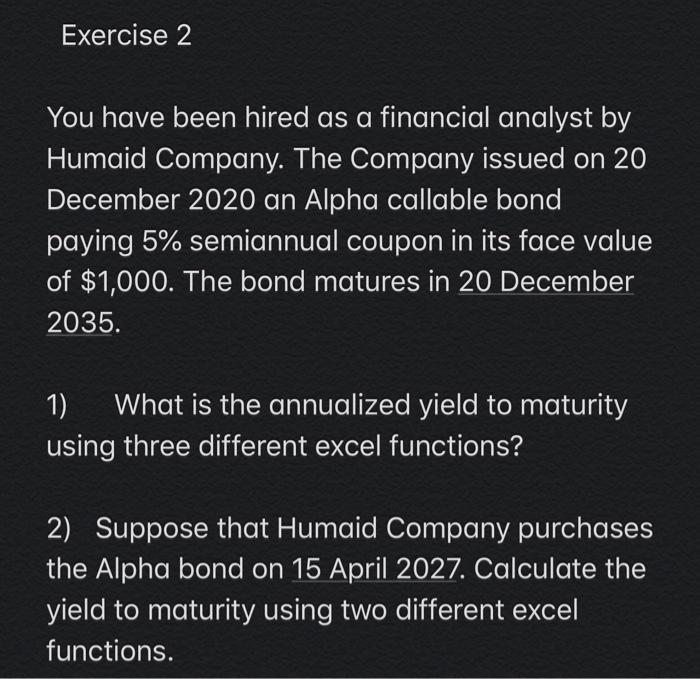

Question: Exercise 2 You Have Been Hired As A Financial Analyst By Humaid Company. The Company Issued On 20 December 2020 An Alpha Callable Bond Paying 5% Semiannual Coupon In Its Face Value Of $1,000. The Bond Matures In 20 December 2035. 1) What Is The Annualized Yield To Maturity Using Three Different Excel Functions? 2) Suppose That Humaid Company Purchases …

Transcribed Image Text from this Question

Exercise 2 You have been hired as a financial analyst by Humaid Company. The Company issued on 20 December 2020 an Alpha callable bond paying 5% semiannual coupon in its face value of $1,000. The bond matures in 20 December 2035. 1) What is the annualized yield to maturity using three different excel functions? 2) Suppose that Humaid Company purchases the Alpha bond on 15 April 2027. Calculate the yield to maturity using two different excel functions.