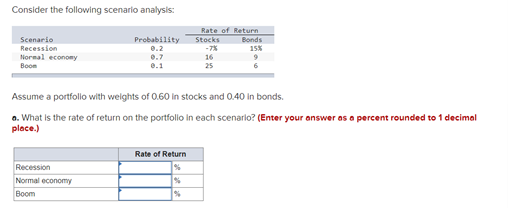

Question: Consider The Following Scenario Analysis: Probability 0.2 Rate Of Return Stocks Bonds Scenario Recession Normal Economy Boom 25 6 Assume A Portfolio With Weights Of 0.60 In Stocks And 0.40 In Bonds. 6. What Is The Rate Of Return On The Portfolio In Each Scenarlo? (Enter Your Answer As A Percent Rounded To 1 Decimal Place.) Rate Of Return % Recession …

Transcribed Image Text from this Question

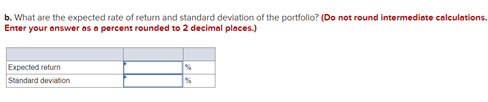

Consider the following scenario analysis: Probability 0.2 Rate of Return Stocks Bonds Scenario Recession Normal economy Boom 25 6 Assume a portfolio with weights of 0.60 In stocks and 0.40 in bonds. 6. What is the rate of return on the portfolio in each scenarlo? (Enter your answer as a percent rounded to 1 decimal place.) Rate of Return % Recession Normal economy Boom % b. What are the expected rate of return and standard deviation of the portfolio? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Expected return Standard deviation